SAP’s Joule: Possibly the Most Promising Enterprise-Grade AI Agent

Mona Zhang

July 31, 2025

Leveraging Gen-AI Means Building AI Agents

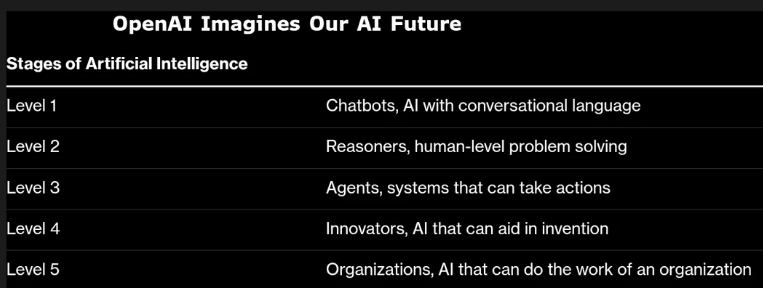

For an enterprise to capitalise on generative AI, it must create

custom-built workflows and applications—that is, AI Agents. Under OpenAI’s “five-stage Gen-AI maturity curve,” the steady rollout of foundation models and middleware standards will eventually allow companies to unlock agent-level use-cases.

Three years have passed since large-language-model fever began, and US- and Europe-based SaaS vendors are now in the thick of an

enterprise-agent launch cycle. In this note, Trunity Partners walks through the AI-Agent offerings from three mainstream providers—ServiceNow, Salesforce and SAP—starting with their low-level architecture, training data and training methods, then inferring each product’s ultimate ceiling and capabilities. We single out the firm most likely to deliver genuine value to its customers—and to achieve step-change improvement in its own business.

Background

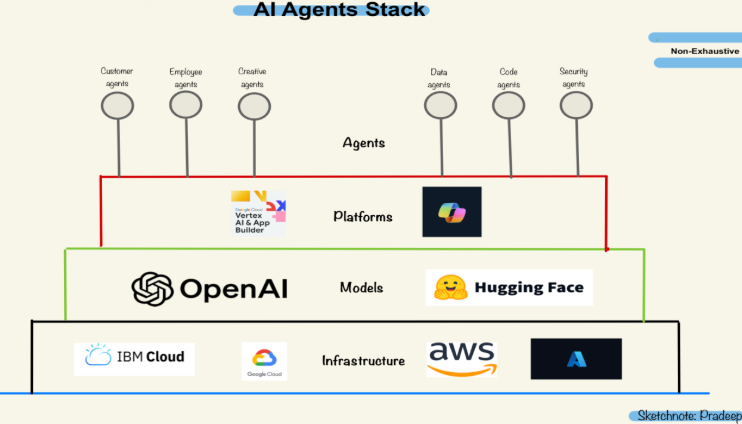

Since early 2024 the term AI Agent has crept into day-to-day conversation. Before the big SaaS houses formally unveiled their products—ServiceNow’s Now Agent, Salesforce’s Agentforce and SAP’s Joule—many enterprises, with help from AI vendors such as Accenture, had already run domain-specific pilots. Most experiments were still chat-bot variants aimed at customer-service efficiency.

The best-known actionable agent is Klarna’s. In early 2024 the consumer-technology fintech fine-tuned OpenAI on two million support chats, refund workflows and risk labels collected over the previous two years, hosting the model on its own AWS stack. The agent can handle dialogues and call internal refund, logistics and billing APIs. During its first month online, it processed 2.3 million conversations—work equivalent to 700 full-time agents—cutting average response time from 11 minutes to two and pointing to an annual saving of USD 40 million.

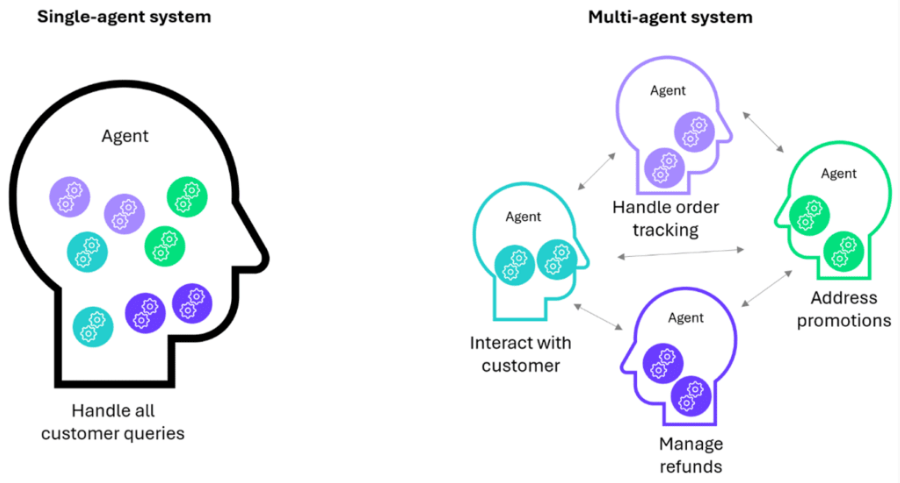

Some firms wondered whether they should design every vertical agent themselves and then orchestrate them with Google’s Agent2Agent tools. In practice that approach fails, mainly because:

- No shared semantic layer. Training data live in multiple SaaS silos with incompatible schemas; even a very large model cannot maintain accuracy.

- Single-task limitation. Home-grown agents usually tackle just one job and cannot span applications—returns plus supply-chain, finance plus CRM—without hand-coded interfaces and business logic, which raises development cost.

- High operating overhead. Firms must build their own observability dashboards and monitoring nodes, with no scale economies.

In the second half of 2024, threatened by customers’ vertical-agent experiments, the major SaaS platforms—some, like SAP, had started in 2022—announced their own enterprise-grade programmes: ServiceNow’s Now Agent, Salesforce’s Agentforce and SAP’s Joule. Oracle, HubSpot and others have yet to launch anything agent-specific. Now that the SaaS providers are pushing agents aggressively, enterprises that run those suites—ERP, HRM, procurement, CRM, ITSM, in other words about 80 per cent of daily workflows—have little incentive to build agents in-house, given the high cost, low efficiency and cross-platform friction. Still, companies will self-build agents in certain situations:

- They write virtually all of their own software (Google, Microsoft, Oracle, SAP).

- Data sovereignty or model secrecy is paramount—defence, drug formulas, trading algorithms—so third-party inference is impossible.

- Their processes sit far outside mainstream SaaS: high-frequency trading, semiconductor-tool scheduling, genome sequencing, carrier-scale IoT analytics.

Today, third-party providers such as OpenAI and Palantir still help customers design and deploy agents, but they lack wide, multi-tenant domain data—thousands of firms’ ERP or CRM logs—and therefore must treat every rollout almost as a bespoke project. In certain verticals they start roughly five years behind the best-prepared SaaS incumbents. Within the SaaS field itself, not every vendor is ready. Winners tend to be the ones that have spent years connecting product lines and data layers; some vendors’ data, weighed down by tech debt, cannot be used to train an agent at all. Put differently, SaaS companies with high-quality data and light tech debt are strengthened, not weakened, by Gen-AI—hence the investment opportunity.

Focus of Our Study

We have concentrated on SAP, ServiceNow and Salesforce. All three have released agents; Oracle, HubSpot and others still embed Gen-AI only at the feature level.

- SAP solved product and database silos under CEO Christian Klein beginning in 2020; its closed-loop, broad business data are perfect for training an intelligent agent.

- ServiceNow has long enjoyed a strong, debt-free platform, but its scope of business data is narrower and largely “edge only,” with no closed loop. To compensate it is acquiring Moveworks, due to close in H2 2025.

- Salesforce moves the slowest. Years of bolt-on acquisitions, a founder CEO whose strategic focus shifts, and the heaviest tech debt of the trio mean its partial database unification depends on data copies, not source-truth tables, introducing cross-cloud latency that remains unresolved.

Detailed Breakdown of Each Vendor’s AI-Agent Strategy

Salesforce

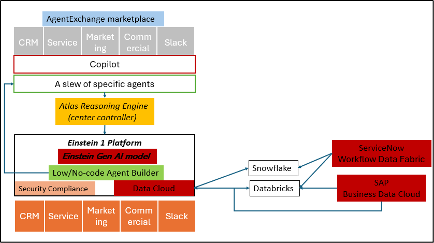

Salesforce packages its agent products as

Agentforce; the controller is the

Atlas Reasoning Engine. Experts agree its value depends entirely on data integration quality—native lakes such as Snowflake or Databricks pipelines. Despite claims that internal integration was “completed” between 2021 and 2024, substantial work remains.

A big reason for the mediocre result is deep-rooted tech debt. Large acquisitions—MuleSoft, Slack, Tableau, Demandware—have never been folded into the core architecture. Experts rate integration “four out of ten.” Even with unlimited money, Salesforce could reach maybe five out of ten, chiefly because of culture: CEO Marc Benioff changes focus frequently; strategy shifts every few quarters, reallocating resources. The sudden Agentforce pivot and several years of mass lay-offs have derailed engineering road-maps. An internal “meeting culture” slows decisions—what a start-up decides in an hour can take a month at Salesforce.

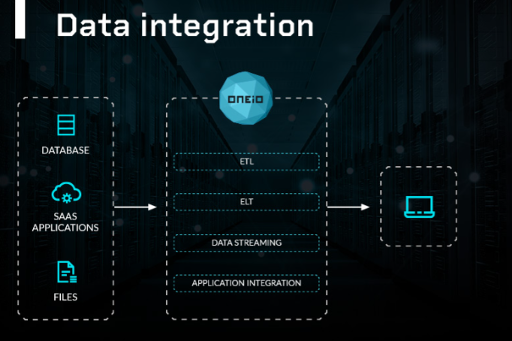

Data Cloud is essentially a data copy, not a source of truth. It does not read real-time data from Sales, Service or Marketing Cloud but copies it via ETL or sync into its own schema for later AI training, segmentation or agent inference. ETL-driven inference can take minutes or even hours, rendering Agentforce unusable in live settings.

Historically, Agentforce is a bundle rather than a breakthrough: Einstein, Datorama and Einstein Copilot plus Atlas for LLM, NLP and generation. The move from Einstein to Agentforce is a fast market reaction to ChatGPT’s 2022 debut and Microsoft’s Copilot. Einstein itself traces back to Datorama, bought in 2015-16, an analytics tool later re-skinned as Einstein Analytics. Between 2023 and 2024 Salesforce grafted LLM tech onto Einstein Copilot for Q&A, then acquired Airkit.ai for no-code agent creation, renamed the bundle Agentforce and promoted “build your own agent.” Lay-offs aimed at cost-control (margin pressure largely driven by tech debt) sapped key talent, many of whom founded rival platform Sierra.ai. Salesforce is now rehiring to rebuild engineering and go-to-market teams.

Culturally, Salesforce struggles to produce a high-performance agent. Key products have historically come from acquisition—an artefact of public-market pressure. Leadership turnover remains high; many treat Salesforce as a career springboard, making execution hard. Sales-led, valuation-oriented culture keeps acquisitions flowing so sales always has a “new story.”

An April expert interview captured the gap: “Despite the marketing buzz, real deployments are extremely cautious; onstage Salesforce likes to show case studies fit for PR, but in practice AI is still confined to ITSM-style chores.” Still, Salesforce plans to subsidise 1 000 customers in Q4 2024 to accelerate AI rollout, prioritising firms already on multiple Salesforce clouds.

Where Agentforce falls short

Data

- Fragile data orchestration. Without strong native integration, Agentforce relies on MuleSoft, Snowflake, Databricks; pipes break, errors rise.

- Latency. A split architecture—UI on core platform, data in public cloud—produces serious lag and coupling; cross-system calls lack speed and consistency, undermining real-time inference.

- No uniform standard. Good on permissions and security, poor on normalising external data—“data present but unusable,” “authorisation complex.”

Reasoning

- Most models still Q&A-centric. Largely retrieval, lacking intent understanding, task planning and autonomous execution.

- Atlas immature. A proper agentic brain needs large-scale training, semantic unity and tool-call logic—none yet in Agentforce. ServiceNow addresses the same gap by buying Moveworks.

- No context memory. The model loses conversational state; cannot optimise across turns, limiting fully automated support or cross-system coordination—capabilities Moveworks brings to ServiceNow.

CEO Benioff knows the stakes; Agentforce touches existential risk. Heavy debt, weak foundations and looming CRM competition from ServiceNow explain Salesforce’s valuation discount.

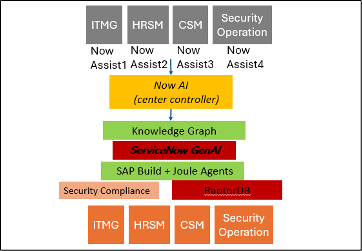

ServiceNow

ServiceNow’s hallmark: nearly all new features are built, not bought. ITSM, HRSM, CSM, SecOps share deep integration; unlike Salesforce, ServiceNow keeps a single code base. Roughly two-thirds of code is reused across modules, so new products—GRC, for example—can ship in 6-8 months. Before 2021, 80 % of R&D went to the platform, 20 % to new products; since 2022 the ratio reversed. A decade of unified-platform discipline means almost no tech debt, although in some niches lack of acquisitions slows expansion.

The main blocker to a true agent is data. Most ServiceNow workflows are single-rule, open-loop. Example: a user requests a four-core Linux VM; pre-configured automation checks permissions, picks a resource pool, calls scripts, waits for external status, then updates the ticket. If any step fails, the workflow stops and hands off to an engineer; the manual steps are not recorded. Such data hardly help train a controller. By contrast SAP’s logs capture “try-fail-adjust-success,” perfect for learning fallback strategies.

To shore up its front-end dialogue and trigger orchestration, ServiceNow is buying Moveworks in 2025. Does that fix the data gap? No. Moveworks specialises in conversational AI for IT support; it lives above systems like ServiceNow. A user tells Moveworks “I can’t log into email,” Moveworks raises a ServiceNow ticket, fills the form, reports back. As Moveworks gets smarter it could abstract ServiceNow into a back-end API. For SMBs, Moveworks plus a simple ticket system might replace parts of ServiceNow, and if Moveworks integrates Jira, Workday or Okta it could become a cross-system console. Thus ServiceNow’s acquisition is part rescue—buying a full-stack agent capability that would take five years to build—and part bid for cross-legacy integration, given its existing “pipe” connections are form-driven and pre-scripted.

SAP

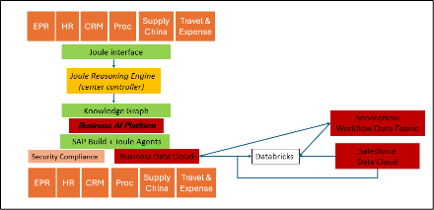

SAP enjoys intrinsic advantages:

- ERP-core data record full closed loops. Users try multiple tactics until success; every step is logged.

- Broadest workflow reach. Beyond ERP, SAP covers HRM, accounting, CRM, procurement, marketing—virtually every corporate function.

- Unified semantics. Since 2020 SAP, under Christian Klein, has merged product lines and databases into Data Sphere and the Business Data Cloud, linking internal data and external Databricks.

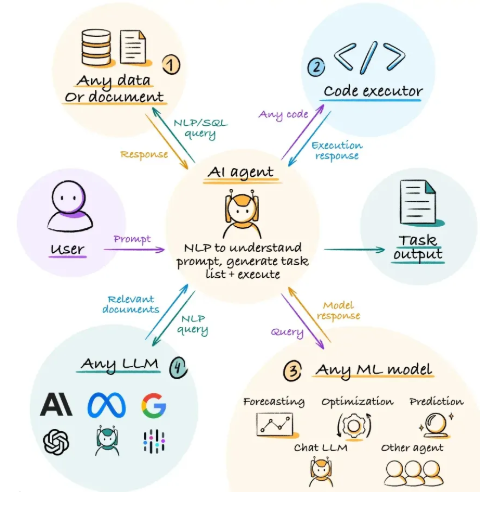

In October 2024 SAP launched Joule AI Agents for finance, customer service and sales, able to automate and optimise processes—data extraction, report generation, baseline workflow triggers—far beyond summarisation or guided Q&A. In 2025 Joule expands into ERP, spend management and HR. Today Joule already offers executable agents, ready-made agents, custom-agent builders, inter-agent collaboration and deep process hooks. SAP plans to release an AI Agent Hub and custom skill-builder in Q3–Q4 2025, accelerating toward a fully autonomous, task-capable agent ecosystem.

Joule is model-agnostic; its strategy centres on a robust Joule Reasoning Engine (controller). Training steps:

- Semantic layer preparation. Authorised data from 30 000+ customers are de-identified, standardised and cross-mapped—master data (customers, suppliers, employees, cost centres), transaction data (POs, invoices, approvals) and behaviour logs (clicks, calls, edits, approval paths).

- Workflow models. Each workflow—create PO, budget approval, sales-order change—has four parts: trigger intent (natural-language goal), required context objects, state timeline, decision branches. Joule learns step-by-step resolution.

- Learning failure paths. SAP’s value is that failed attempts are logged. Example: a buyer raises a large PO, budget mismatch causes rejection; the buyer splits the order, uses another GL, or invokes a special procurement type. Each adjustment is recorded—status changes, field edits, time gaps, exception logs—rich data for fallback learning.

- Co-training with an LLM for text generation, question formation, copy writing, anomaly analysis, tailoring the LLM to enterprise contexts.

- Knowledge-graph fusion so the agent can, for example, map a sales order to its customer, credit rating, bank account, owner and permissions, or pull every stakeholder into a contract-approval flow—functions that partly supplant ServiceNow.

Thanks to high-quality data and Klein’s integration groundwork, Joule moved from concept to launch in about 20 months:

- mid-2022 – platform groundwork, data unification, database build, AI platform design, workflow inventory.

- early-2023 – full training begins; workflows—successful, failed, rerouted—feed the brain.

- Sept 2023 – first embed inside ERP, HR, finance, procurement.

- early-2024 – Joule can handle 100+ common scenarios (POs, staff transfers, invoice approvals), with fallback paths.

- mid-2024 – coverage extends to manufacturing, sales, supply chain, IT ops.

- by Q1 2025 – “More than 1 300 skills across 130+ use-cases; automates 80 % of daily SAP tasks.” Budgeting and forecasting run up to 80 % faster; market-analysis cycle time down 90 %; procurement data queries 95 % faster.

Commercially, Joule is bundled into

RISE with SAP – Premium Plus. Over the past five years, SAP’s main growth engine has been migrating on-prem ERP users to cloud; Joule should accelerate that shift and drive uptake of ancillary SaaS modules (CRM, HR, finance, procurement), supporting revenue growth for the next half-decade.

Disclaimer: This article is for informational and educational purposes only and does not constitute financial, investment, legal, or tax advice. The views expressed are my own and do not necessarily reflect those of Trunity Partners Ltd. or its affiliates. Any references to specific assets, historical events, or individuals are for illustrative purposes and do not imply endorsement or prediction of future performance. Readers should conduct their own due diligence or consult a licensed advisor before making investment decisions.