The Monetary Half-Life of Gold: A Strategic Reframe

Mona Zhang, CFA

April 23, 2025

“Bitcoinis the most efficient system in the history of mankind for channeling energy through time and space.” — Michael Saylor

Gold has long been seen as immutable and eternal — a monetary constant in human civilization. But what if even gold, in a monetary sense, has a half-life?

This idea was first introduced by Michael Saylor, who framed gold’s decay not as physical deterioration, but as the gradual erosion of its monetary utility — due to storage friction, trust dependency, and systemic vulnerabilities. It was one of the most thought-provoking insights I've encountered in recent monetary theory.

🔍 Expanding on Saylor’s Insight

Inspired by this concept, I’ve attempted to quantify the idea of gold’s half-life using an exponential decay model — much like we use in physics for radioactive substances.

While Saylor introduced the “half-life of gold” concept, this article builds on it by identifying and modeling the real-world decay factors that undermine gold’s monetary effectiveness over time.

❓ What Is the Monetary Half-Life of Gold?

The monetary half-life is the time it takes for gold to lose 50% of its effective utility as a monetary asset, not because it tarnishes, but because it becomes less efficient, less secure, and more reliant on trust-based infrastructure.

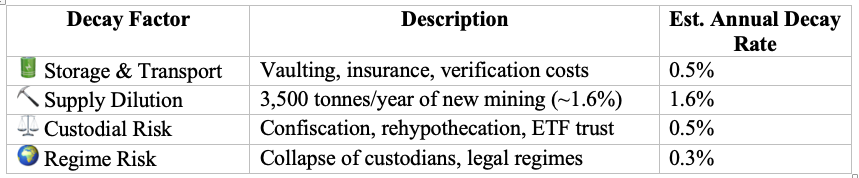

🔬 Breaking Down Gold’s Monetary Decay

📌 Methodology Notes

Custodian Risk (~0.5%):

- 1933: U.S. Executive Order 6102 (gold confiscation)

- 2020s: Venezuela unable to retrieve gold from Bank of England

- ETFs: Legal control rests with the fund, not the holder

- Over a 100-year period, custodial failure events affect 40–60% of sovereigns

✅ Conservative estimate: ~0.5% per year cumulative risk exposure

Geopolitical Regime Risk (~0.3%):

- Empirically, ~30% of countries experience regime change every 20–30 years

- These events often lead to asset expropriation, capital controls, or invalidation of custodial agreements

✅ Interpolated to ~0.3% decay per year due to legal discontinuity risk

Total annual decay rate: ~2.9%

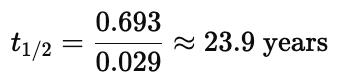

Using the exponential half-life formula

✅ Estimated monetary half-life of gold = ~24 years. Namely, it takes 24 years for gold to lose its utility value by half.

🟠 Why Bitcoin Is Different

Unlike gold, Bitcoin has no physical drag:

- No storage or transport cost

- No dilution after 2140

- No trust required if self-custodied

- No geographic limitation

Bitcoin’s issuance halves every four years, but this isn’t its monetary half-life — it’s part of its programmed monetary policy. If anything, Bitcoin’s monetary half-life is theoretically infinite, provided the network integrity holds.

📉 Strategic Implications

Gold will always have historical and symbolic value. But if we take Saylor’s insight seriously — and measure gold’s monetary energy decay — we see a slow, predictable erosion.

In a digital-first world, allocators must ask:

How long can we afford to store value in a medium with a decaying monetary half-life?

🙏 Credit Where It’s Due

This article builds directly on the ideas of Michael Saylor, who introduced the monetary half-life of gold and the notion of Bitcoin as a pure monetary energy network. I'm simply running the math and expanding the framework he laid out.

💬 Would love to hear your thoughts:

- Does the monetary half-life of gold change your perspective?

- What other legacy assets could we model this way?

#Bitcoin #Gold #MichaelSaylor #MonetaryHalfLife #StoreOfValue #DigitalAssets #AssetAllocation #Macro

Disclaimer:

This article is for informational and educational purposes only and does not constitute financial, investment, legal, or tax advice. The views expressed are my own and do not necessarily reflect those of Trunity Partners Ltd. or its affiliates. Any references to specific assets, historical events, or individuals are for illustrative purposes and do not imply endorsement or prediction of future performance. Readers should conduct their own due diligence or consult a licensed advisor before making investment decisions.