From Traditional Assets to Bitcoin: Key Takeaways from the Trunity June Investment Seminar

Mona Zhang, Dr. Lei Jiang

June 13, 2025

Opening and Macro Context: From Monetary Distortions to Asset Repricing

On the evening of June 13, 2025, Trunity Partners hosted a private online seminar focused on Bitcoin, co-led by Managing Partner Mona Zhang and guest speaker Dr. Lei Jiang. In this nearly two-hour discussion, the speakers did not attempt to mythologize Bitcoin. Rather, they situated it within the broader reality of global asset allocation—building a framework suitable for high-net-worth investors by exploring macro-level monetary structures, financial system vulnerabilities, the technical and asset-level properties of Bitcoin, and its path toward institutional adoption.

The session opened with remarks from Mona Zhang, who emphasized that the purpose of this seminar was not to recommend “all-in” allocations to any single asset class. Instead, the intention was to highlight that we are currently undergoing a global repricing of assets. In this context, the roles of traditional assets—equities, real estate, and bonds—are being reshaped, while Bitcoin is steadily shifting from a fringe speculative instrument toward a new category: allocatable asset.

Mona pointed out that the core tension in global financial markets today is not merely inflation or geopolitical conflicts, but rather the prevalent “double bind” structure faced by governments: extremely high debt levels and deep reliance on leverage. The outcome of this structure is that, when faced with economic slowdowns or liquidity stress, central banks have virtually no choice but to expand their balance sheets to inject monetary support. While often referred to as “money printing,” the essential function is to prevent systemic liquidity collapse by positioning the central bank as the lender of last resort.

In such a climate, the nature of asset management is undergoing a fundamental shift. Investors are no longer focused solely on yield—they are re-examining a more basic question: Where can my assets truly preserve value? The reason Bitcoin is gaining more attention is not because it offers high short-term returns, but because its very existence—as an asset external to the traditional system and governed by endogenous rules—constitutes a hedge against the architecture of today’s financial regime.

Mona’s introduction set the tone for the entire seminar: Bitcoin is not an isolated, exotic asset. Rather, it is becoming a legitimate, institutionalized, and comparable new member within the global asset allocation landscape.

The Essence of Bitcoin: From Ledger Architecture to Consensus Network

(Summary of Dr. Lei Jiang’s Presentation)

Before delving into the technical intricacies of Bitcoin, Dr. Lei Jiang began with a foundational question: “How do we store wealth?”

He emphasized that wealth is not abstract—it must be attached to a medium that can be recorded, transferred, and preserved. From ancient shells and paper currency to modern bank accounts and digital certificates, humanity has continually evolved the ways in which wealth is carried. Bitcoin, he argued, represents the first comprehensive reimagining of this "wealth carrier" using decentralized technology.

“We want the work we do today to be recorded, and for that record to remain valid tomorrow, next year, and ten years from now. That is the essence of storing wealth.”

From this perspective, Bitcoin is foremost a globally shared ledger system that does not rely on any centralized institution, yet fulfills the fundamental functions of a wealth carrier: recording, tamper-resistance, verifiability, and free transferability. Dr. Jiang stressed that Bitcoin should not be viewed simply as “money” in the traditional sense, but rather as a redefinition of money’s underlying logic.

He further explained that Bitcoin is, at its core, a synthesis of four distinct components: a ledger (Ledger), a peer-to-peer network (Peer-to-Peer Network), consensus rules (Consensus Rules), and a proof-of-work mechanism (Proof-of-Work). He then unpacked each of these elements as follows:

1. Ledger Architecture: Clear Ownership Records

Dr. Jiang used the metaphor of “safes” to explain Bitcoin’s account model. Each address functions like a safe with a unique serial number and corresponding key (private key). Owning the key grants control. A transaction, then, is like depositing a coin from one safe into another. This process requires no third-party mediation—as long as it adheres to the network’s consensus rules, it is valid.

This structure eliminates the risk of forgery and double-spending and forms the foundation of Bitcoin’s anti-fraud mechanism.

2. Blockchain Structure: Chronology and Immutability

Bitcoin transactions are not scattered; instead, they are bundled into “blocks.” Each block contains thousands of transactions and is sequentially linked to its predecessor, forming the “blockchain.”

Dr. Jiang emphasized that the core significance of this structure lies in its ability to enforce chronological order and prevent tampering. Each record is backed by the prior block, creating a ledger that is both transparent and verifiable.

3. Peer-to-Peer Network: A Resilient, Decentralized System

The Bitcoin network consists of tens of thousands of nodes globally. Each node stores a full copy of the ledger, and anyone can participate freely—there is no central server.

Dr. Jiang highlighted that this architecture is not only censorship-resistant and fault-tolerant but also represents a fundamental challenge to the traditional banking model, where only a select few can write to the ledger. In Bitcoin, the right to write is open to competition.

4. Consensus Mechanism: How Decentralization Coordinates Agreement

With so many nodes maintaining a copy of the ledger, how is consensus reached on which version is valid? Dr. Jiang elaborated on the proof-of-work mechanism.

Miners compete to solve a mathematical puzzle. The first to solve it earns the right to write the next block. Though energy-intensive, this requirement for physical resource expenditure ensures security and immutability.

“This privilege isn’t granted based on identity or status—it’s determined by computational effort and resource input. It is inherently a decentralized competition.”

5. Quantum Computing and Security: Bitcoin’s Evolutionary Resilience

During the Q&A, an attendee raised a concern: Would quantum computing render Bitcoin’s cryptography obsolete?

Dr. Jiang responded, “Once quantum computing matures, it won’t just threaten Bitcoin—it will impact the entire infrastructure of internet security, banking, and communications, all of which depend on public-key encryption.”

He emphasized that Bitcoin is an open-source protocol, capable of upgrades. If current encryption schemes are compromised, the community can implement quantum-resistant alternatives through protocol updates. He likened this to human cells constantly regenerating: as long as core parameters such as the 21 million supply cap and block intervals remain unchanged, the system retains its identity.

Dr. Jiang concluded that Bitcoin’s security does not rest on invulnerable code, but on a governance process capable of adaptation and integrity over time.

Bitcoin in a Macro Perspective: An Alternative in the Era of Structural Currency Debasement

(Summary of Mona Zhang’s Remarks)

Following Dr. Lei Jiang’s explanation of Bitcoin’s architecture from a technical standpoint, Mona shifted the discussion to a broader macroeconomic context: Why are more and more financial professionals turning their attention to Bitcoin?

She pointed out that today’s economic environment is defined by two key structural features: high debt levels and unlimited monetary easing. This is not a local anomaly of any single country—it is a global and systemic phenomenon. Mona summarized this trend using a phrase widely circulated in financial circles:

“All roads lead to dollar debasement.” In other words, regardless of the policy path taken, the outcome will be currency depreciation.

Government Debt Out of Control: Money Printing as the Only Option

Mona stressed that many governments, especially in developed economies, are facing unprecedented fiscal challenges. Most are technically insolvent, with chronic deficits and a growing debt burden. Regardless of whether a government pursues left-leaning spending or right-leaning tax cuts, the ultimate burden falls on the central bank, which is compelled to fill the gap through monetary issuance.

This structural dilemma implies that the coming decade will be shaped by an economic cycle driven by monetary expansion. The result: real and persistent currency debasement.

Asset Allocation Strategy: Bitcoin, Gold, and High-Quality Equities as a Three-Pronged Defense

Against this backdrop, Mona proposed a strategy tailored for high-net-worth investors: a triangular hedge against fiat dilution consisting of gold, Bitcoin, and high-quality equities.

- Gold serves as a millennium-tested store of value and acts as a “final vault” in times of extreme events or systemic distrust in fiat currencies.

- High-quality stocks represent productive assets. Companies with global pricing power, strong moats, and long-term growth potential can pass on inflationary costs and preserve profit margins.

- Bitcoin, due to its programmed scarcity and independence from centralized issuers, functions as a systemic hedge. It is especially suited for cross-cycle, cross-border wealth allocation.

“If we are to preserve family wealth over the next decade, a coordinated allocation to these three types of assets is critical.”

While Bitcoin is more volatile than the other two, Mona emphasized that its non-dilutable supply and censorship resistance confer a distinct value. It does not rely on counterparty credit or national legal systems and is inherently compatible with asset circulation in the digital age.

Why Bitcoin Is Being Institutionally Integrated into Global Portfolios

Mona concluded that the global fiat-based financial system is increasingly fragile. With limited policy flexibility, frequent risk events, and stretched credit systems, more investors are turning to “insurance hedges” against systemic monetary risk. Bitcoin, gold, and equities in top-tier enterprises form the three pillars of this hedging logic.

Bitcoin’s Allocation Trend and Regulatory Landscape

(Continued Summary of Mona Zhang’s Remarks)

From Fringe to Framework: Bitcoin Enters the Institutional Arena

For most of the past decade, Bitcoin was widely regarded as a speculative asset—highly volatile, unregulated, and risky. But Mona noted that this perception is undergoing a profound transformation:

“Bitcoin is evolving from a retail speculative instrument to an institutional allocation tool.”

She cited a key milestone: the approval of spot Bitcoin ETFs by the U.S. SEC. These vehicles now allow traditional investors—including pension funds, family offices, and sovereign wealth funds—to gain regulated and transparent exposure to Bitcoin. This move grants Bitcoin legitimacy in the context of asset allocation.

According to data from CoinShares, as of May 2025, global Bitcoin ETFs hold over 1 million BTC, representing nearly 5% of the total supply. Mona emphasized that this blend of physical custody and regulatory integration is turning Bitcoin from a “philosophical consensus” into a “capital consensus.”

Who Has Already Allocated?

Mona shared examples of companies and investors that have already incorporated Bitcoin into their balance sheets or strategic portfolios:

- Corporate Holdings: MicroStrategy: ~560,000 BTC Tesla: >10,000 BTC Block Inc. (formerly Square)

- Notable Investor Endorsements: Paul Tudor Jones: Views Bitcoin as a hedge against fiat debasement Stanley Druckenmiller: Acknowledges Bitcoin as a “store-of-value contender” Ray Dalio: While cautious, recognizes its value in portfolio diversification Cathie Wood (ARK Invest), Michael Saylor (founder of MicroStrategy): Prominent advocates

Mona concluded that these endorsements reflect more than personal views—they signify the rise of a mindset: in an era of structural currency debasement, investors require asymmetric asset insurance.

Regulatory Attitudes Are Shifting from Hostility to Integration

During the seminar, Mona also addressed the latest regulatory signals from the United States. In a recent interview, CFTC Acting Chair Caroline Pham indicated a shift in tone.

With backing from the Trump administration, Bitcoin is now seen as one of the “strategic technologies that America can lead in”. Regulatory focus, she said, will prioritize fraud prevention over antagonism toward crypto assets themselves.

“We want to ‘Uber-ize’ crypto,” Pham said—implying that when a technology reaches mass adoption, regulation cannot suppress it but must instead guide it through integration.

This stance aligns with recent trends in Europe and Hong Kong, where clearer regulatory frameworks are emerging. Mona concluded that the convergence of regulatory clarity, technical stability, and institutional capital is propelling Bitcoin from the fringe to the mainstream.

From Wallets to Risk Management: A Practical Methodology for Bitcoin Investment

(Dr. Lei Jiang’s Remarks)

After explaining the ledger structure and security logic of Bitcoin, Dr. Lei Jiang returned to a question that matters most to investors: “So, how do we actually buy Bitcoin?”

He refrained from discussing market trends or encouraging speculation. Instead, speaking as a technologist, he offered a clear and pragmatic breakdown of how Bitcoin can be incorporated into a retail investor’s portfolio.

1. Multiple Access Channels

Dr. Jiang pointed out that Bitcoin today is no longer the niche novelty of 2011 internet forums. It has evolved into a robust financial asset with systemic infrastructure and diverse acquisition channels:

- “Friends in Canada can use Bitbuy or Wealthsimple; in the U.S., Coinbase and Kraken are widely adopted; in Hong Kong, Hashkey provides a compliant entry point.”

- “ETFs are a more beginner-friendly route, especially for those who prefer traditional brokerage channels.” He specifically highlighted IBIT (BlackRock) and ARKB (Ark Invest) for their liquidity and fee advantages.

2. The Core Concept of Self-Custody

He emphasized one core principle:

“Not your keys, not your coins.”

This, he said, is not just a slogan, but a red line in value orientation. “Storing Bitcoin on an exchange is like putting gold bars in someone else’s vault—and they hold the keys,” he explained. True ownership means controlling your own private keys.

Dr. Jiang introduced several custody options, including software wallets, hardware wallets, and multi-signature setups. He also briefly explained key standards like BIP39 mnemonic phrases and BIP44 hierarchical paths, the technical backbone of wallet systems.

3. Awareness of Risk and Boundaries of Operation

He closed his segment with a checklist of practical warnings—market volatility, technical risks, regulatory uncertainties. The tone was calm, not alarmist, yet every point was concrete and actionable.

Trunity’s Investment Lens: Positioning Bitcoin in Portfolio Strategy

(Remarks by Mona Zhang)

Following Dr. Jiang’s technical overview, Mona re-centered the discussion on the investor’s perspective: “If you’re concerned about protecting family wealth, how should you evaluate Bitcoin today?”

1. An Evolving Research Framework

Mona introduced Trunity’s approach to Bitcoin analysis, emphasizing that it’s not about making simplistic macro calls, but about structurally assessing Bitcoin’s asset properties.

She shared several tools used in the team’s ongoing research:

- On-chain data to track wallet behavior and transaction structures;

- Institutional participation, such as ETF flows and updates on newly listed Bitcoin treasury companies;

- Cross-asset correlation analysis with gold, tech equities, and bonds—always tied to macroeconomic context;

- Policy tracking, including developments from the CFTC, SEC, state-level legislation, and international regulatory frameworks.

“This isn’t just about whether to overweight or underweight Bitcoin—it’s about building a cognitive framework akin to traditional macro

allocation models.”

2. A Three-Asset Hedge Against Fiat Debasement

She proposed a configuration that is easy to understand for investors:

“We are now in a globally synchronized cycle of fiat dilution. Anyone seeking to preserve value must construct a portfolio designed to resist monetary erosion.”

Her suggested framework involves three dimensions:

- Gold – the trust anchor of millennia;

- Bitcoin – a coded monetary system;

- High-quality equities – productive assets with high moats and growth potential.

“One is tangible, one is digital; one is old, one is new; one is for growth, one for stability—together, they form an anchor point of wealth outside the fiat system.”

Mona concluded:

“Bitcoin is not the only answer. But in this moment in history, it has become an answer we can no longer ignore.”

Critical Focus: Will Bitcoin Survive the Rise of Quantum Computing?

Audience Q&A – A Widely Asked Question in the Tech and Media World

During the Q&A session, one participant asked a question that has been circulating widely in recent years on both media and technical forums:

“If quantum computing advances significantly, wouldn’t it be able to crack Bitcoin’s private keys? Could my Bitcoin holdings one day become worthless?”

This question struck a chord with many, as it touches on the very foundation of Bitcoin’s security—whether private keys can be broken by future supercomputers.

Dr. Lei Jiang’s Response: Upgrading a Living System in the Face of Technical Evolution

Dr. Jiang gave a pragmatic and layered answer:

1. Quantum computing is far from practical deployment

“Most current discussions are based on theoretical models. A quantum computer that can truly break elliptic curve encryption—the algorithm Bitcoin currently uses—is still at least ten years away from engineering feasibility.”

2. If quantum computing becomes viable, Bitcoin is not the only one affected

“Banking systems, military communications, government secrets, online payments… anything that uses encryption will be impacted. Bitcoin would be just one small part of a much larger problem.”

3. Bitcoin is software—it can be upgraded

“Most importantly, Bitcoin is a protocol. If the community reaches consensus, it can adopt quantum-resistant encryption algorithms through network upgrades.”

Dr. Jiang illustrated this with a vivid analogy:

“Think of the human body. Your skin cells renew every few days, bone cells every seven years. After seven years, every cell in your body has been replaced—but you’re still you.

The internet, browsers, mobile OS—they’ve all evolved over time, but their identity and function persist. Bitcoin will be the same.”

Mona Zhang’s Addendum: Distinguishing Quantum Fear-Mongering from Reality

From an information environment perspective, Mona added a critical reminder:

“Recently we’ve seen many funding announcements tied to quantum computing, with projects using phrases like ‘Bitcoin will be disrupted’ to grab attention. We must distinguish scientific advancement from marketing hype.”

She noted that similar “quantum panic cycles” occurred in 2017 and 2020—each time eventually debunked as premature alarmism.

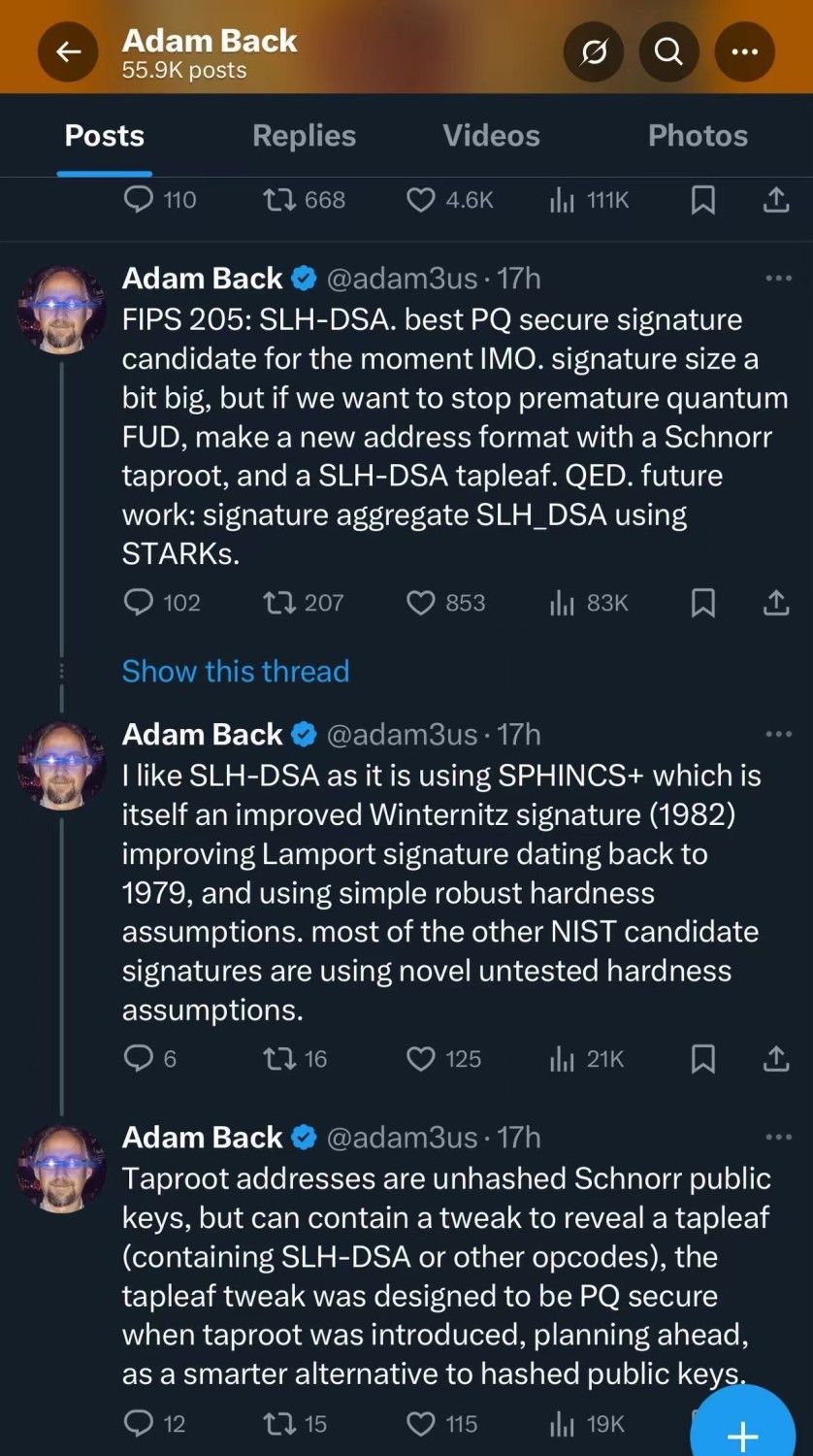

Adam Back’s Technical Clarification: Yes, Bitcoin Can Be Quantum-Resistant

Mona also shared a tweet from Adam Back, a veteran cryptographer and the only person directly cited by Satoshi Nakamoto in the Bitcoin white paper. In it, he publicly addressed the quantum threat:

- Several quantum-resistant signature algorithms (e.g., SLH-DSA, XMSS) are actively being developed for Bitcoin;

- If a quantum breakthrough ever materializes, the protocol can be smoothly upgraded;

- “Most people fear a sudden quantum attack that wipes everyone’s coins—but in reality, the system can respond faster than threats emerge.”

Bottom Line: Quantum ≠ the End of Bitcoin

“What we should really worry about isn’t whether algorithms are advanced enough—but whether Bitcoin’s governance process remains healthy.”

That was Dr. Jiang’s final note. Bitcoin’s greatest challenge has never been its code, but its consensus.

As long as its open-source governance process remains transparent, participatory, and adaptive, any security threat can be addressed through engineering solutions.

Technical Supplement: Understanding Adam Back’s Quantum-Resistant Proposal – SLH-DSA

To help readers without a technical background better understand the feasibility and security foundations of quantum-resistant upgrades, here is a breakdown of Adam Back’s tweet about SLH-DSA—one of the most promising quantum-safe signature schemes for Bitcoin.

📌 What is SLH-DSA?

- Full Name: Stateless Hash-Based Digital Signature Algorithm

- Design: Based on cryptographic hash functions, without requiring persistent memory for signature sequencing

- Advantage: Ideal for large-scale deployments due to its “stateless” nature

- Status: Considered one of the most mature quantum-resistant signature candidates and currently under NIST standardization (FIPS 205 draft)

🧠 Breakdown of Adam Back’s Tweet

1. Signature Scheme Evaluation

“FIPS 205: SLH-DSA. best PQ secure signature candidate for the moment IMO. signature size a bit big, but if we want to stop premature quantum FUD…”

Interpretation:

- SLH-DSA is the leading post-quantum (PQ) digital signature algorithm today;

- Though the signatures are larger in size, this is a reasonable trade-off for stronger security;

- The reference to “FUD” (Fear, Uncertainty, Doubt) addresses the widespread but often unfounded panic about quantum threats.

2. Taproot and Signature Integration

“make a new address format with a Schnorr taproot, and a SLH-DSA tapleaf…”

Interpretation:

- Taproot (activated in Bitcoin in 2021) supports hiding complex logic inside simplified public keys;

- SLH-DSA can be embedded within Taproot as a “tapleaf”, to be revealed only when needed;

- This design future-proofs Bitcoin, making quantum-resistant upgrades backward-compatible.

3. Aggregation for Scalability

“future work: signature aggregate SLH-DSA using STARKs.”

Interpretation:

- STARKs (Scalable Transparent ARguments of Knowledge) are advanced zero-knowledge proof systems;

- Future development may enable aggregating many SLH-DSA signatures into a single verifiable proof, reducing blockchain storage costs and enhancing efficiency.

🔒 Why SLH-DSA Is Considered Secure

- Hash-Based Security Unlike ECDSA (used today), which relies on the discrete logarithm problem, SLH-DSA uses hash functions, which remain quantum-resistant due to the lack of quantum acceleration for brute-force attacks.

- Rooted in Proven Cryptography It builds on SPHINCS+, a NIST-selected post-quantum finalist, and inherits robustness from 1980s Winternitz and Lamport signature structures.

- Conservative Design Philosophy Prioritizes auditability, simplicity, and avoidance of untested mathematics, ensuring operational reliability.

✳️ Final Thought: Bitcoin’s Quantum Upgrade “Backdoor” Is Already in Place

Thanks to forward-looking designs like Taproot, proposed algorithms such as SLH-DSA can be introduced without altering Bitcoin’s issuance logic or monetary policy.

“Bitcoin’s quantum resistance isn’t speculative—it’s an engineering process already underway.”

Guest Speaker Bio | Dr. Lei Jiang

- Undergraduate in Economics | PhD in Computer Science

- Quantitative Systems Architect | Bitcoin Researcher

Dr. Jiang holds a bachelor’s degree in Economics and a PhD in Computer Science from North America. He has served as a quantitative systems architect and partner at a quantitative fund, specializing in systematic strategy and financial modeling. He is also a cross-disciplinary thinker with a deep interest in East-West cultural synthesis.

Since 2017, Dr. Jiang has followed the Bitcoin protocol from a research-driven lens. His teaching style integrates programming logic with monetary philosophy, making complex blockchain concepts accessible to non-technical investors.

He has authored essays such as Bitcoin 101, A New Brave World, and On Cryptographic Tokens. His recent work explores the reconstruction of value through the “digital-energy-matter” triad. Dr. Jiang is a lead technical speaker in Trunity’s “21st Century Reserve Assets” seminar series.

Disclaimer: This article is for informational and educational purposes only and does not constitute financial, investment, legal, or tax advice. The views expressed are my own and do not necessarily reflect those of Trunity Partners Ltd. or its affiliates. Any references to specific assets, historical events, or individuals are for illustrative purposes and do not imply endorsement or prediction of future performance. Readers should conduct their own due diligence or consult a licensed advisor before making investment decisions.