From Hype to Reality: Why Enterprise AI Adoption Faces Deep Structural Barriers

Mona Zhang, CFA

March 31, 2025

In the second half of 2024, our research team at Trunity observed a pivotal shift in how we assess the investability of the AI-related themes. The stock markets, we believe, have priced in an overly optimistic view of AI’s commercial maturity—well ahead of its actual enterprise adoption curve.

Recent comments by Microsoft CEO Satya Nadella in a long-form interview with Dwarkesh Patel resonate with this view. He emphasized that the real challenge with AI is not computing power, but the organizational workflows and a "end-to-end process..that continuous improvement.."

"This is like Lean for knowledge work, in particular. And that's going to be the hard work of management teams and individuals who are doing knowledge work, and that's going to take its time.” —— Satya Nadella, from “Microsoft’s AGI Plan & Quantum Breakthrough”

In other words, AI is not a plug-and-play tool. It’s a catalyst for systemic reconstruction of knowledge workflows.

At Trunity, we began forming a similar view in the second half of last year:

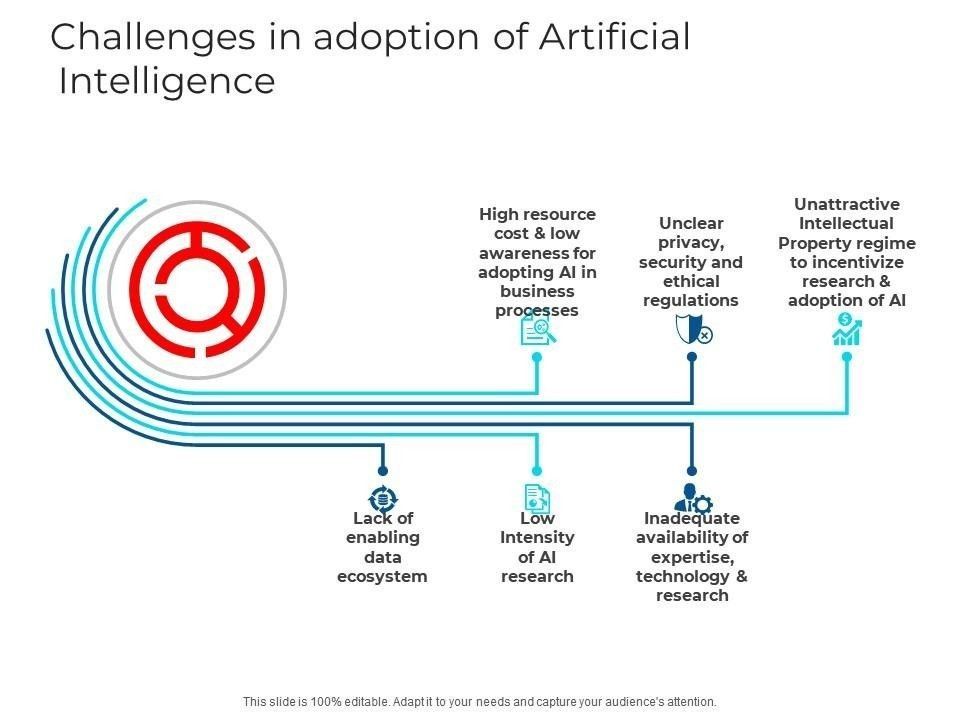

- Enterprise data structures, security standards, and compliance mechanisms are not yet AI-ready.

- Legacy processes and organizational inertia slow down implementation efficiency.

- Infrastructure spending is front-loaded, ahead of actual business conversion—creating a near-term oversupply.

Together, these issues form a gap between visibility and usability. We see the current correction in AI stocks not as a signal of technological exhaustion, but as a revaluation of its commercial timeline.

“But by the way, the classic supply side is, "Hey, let me build it and they’ll come."”

“But at some point, the supply and demand have to map. That's why I'm tracking both sides of it.” —— Satya Nadella

While infrastructure is booming, enterprise demand remains unclear. The "compute build-up" reflects expectation speculation, not demand fulfillment. Nadella further notes:

“That's one of the reasons why even the disclosure on the inference revenue... It's interesting that not many people are talking about their real revenue.”

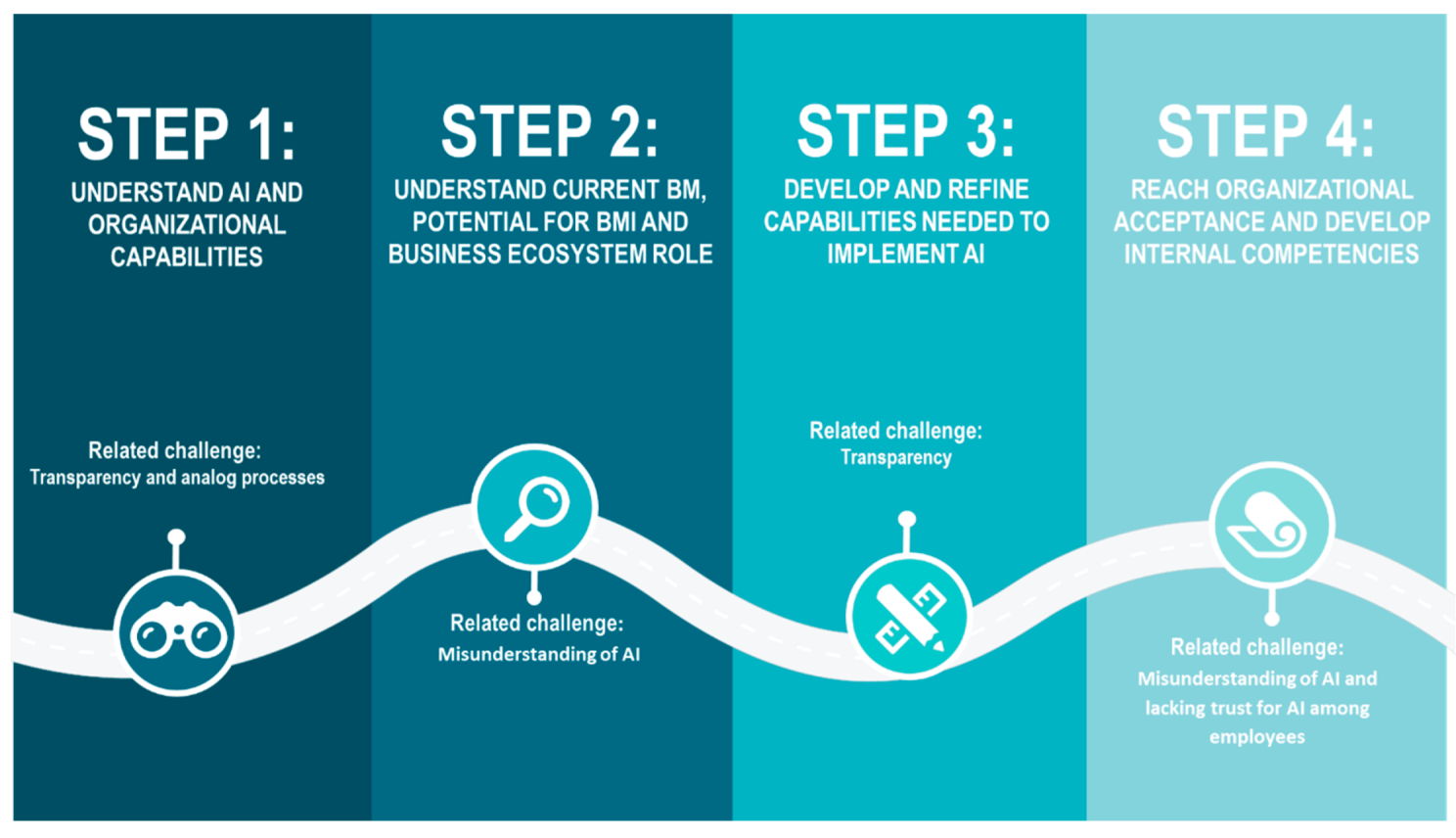

Ultimately, to unlock the value of AI, it hinges on how well organizations upgrade their data governance, decision workflows, incentives, IT system, and compliance coordination—a complex process that touches power structures and strategic design.

📎 A Case Study: Why A Slack Rollout Didn’t Succeed

Years ago, A friend of mine led an initiative to implement Slack within their investment team, a product that arguably redefined organizational communication when it launched in 2014. Its “channel-based” architecture promised to replace linear email threads with real-time collaboration. It would, in theory, organize and facilitate team discussions more effectively.

But in practice, the implementation ran into resistance—not due to the tool itself. But because of other issues were at play—centered on

knowledge ownership and incentive mechanism:

- Will shared discussions be archived? Who owns the final version?

- How to measure contribution when multiple team members collaborate on the same research project?

- Should junior and senior employees have equal access to strategic information?

These concerns went beyond moving your chatbox to a new software, it revealed a deeper organizational tension: Is knowledge a personal asset, a team asset, or a company asset? if either way, how do we manage it?

Before moving on to a more centralized and collaborative workflow (Slack in this instance, assuming that a central data repository is agreed on), a team or an organization needs to decide on:

- An incentive systems that value collaborative work

- Careful though-through of channel permissions management

- Integration with existing IT infrastructure, audit, and compliance system

Ultimately, the Slack deployment was shelved. But their lesson stayed with me: The hardest part of enterprise technology isn’t the tech—it’s the organizational redesign it requires.

🧭 Why SMEs May Lead AI Adoption | Trunity's Case

Compared to large institutions with rigid structures,

small and mid-sized enterprises (SMEs) may be better positioned to implement AI:

- Shorter decision chains;

- Greater process flexibility;

- Lower political and structural resistance.

At Trunity, our research team piloted AGI-assisted tools internally a year ago. By standardizing data structures and streamlining workflows, we achieved substantial improvements in transparency and efficiency—something I believe is harder to accomplish at scale.

History may repeat itself: AWS’s early adopters were also SMEs. In the AI wave, the pattern may be similar.

🧮 Our 2024 Field Research: A Structural Mismatch

Throughout 2024, we conducted extensive field research into the AI value chain—including valuations, infrastructure buildup, and enterprise readiness.

Through interviews with AI infrastructure firms, cloud service providers, and AI SaaS startups, we formed a clear conclusion:

Capital expenditure in AI infrastructure is far ahead of enterprise demand maturity. Commercial viability by and large remains incomplete.

These frontline insights helped us stay clear-headed in our strategy formulation:

- Avoiding the hype cycle;

- Staying focused on long-term architectural evolution;

- And concentrating on companies with true end-to-end technical and commercial integration.

🔚 Conclusion

What Satya Nadella articulates is not AI hype, but the sober reality of organizational transformation.

The next phase of AI won’t be built on GPUs—it will be built on process diagrams. Not in parameter counts, but in institutional design.

“AI is like Lean for knowledge work... That’s going to be the hard work of management teams.” —— Satya Nadella

If you'd like to follow our long-term research on enterprise AI, digital infrastructure, or innovation governance, feel free to connect or message me. Happy to exchange thoughts.

Disclaimer: This article is for informational and educational purposes only and does not constitute financial, investment, legal, or tax advice. The views expressed are my own and do not necessarily reflect those of Trunity Partners Ltd. or its affiliates. Any references to specific assets, historical events, or individuals are for illustrative purposes and do not imply endorsement or prediction of future performance. Readers should conduct their own due diligence or consult a licensed advisor before making investment decisions.